- 1800 890 0803

- Our Global Offices - India | UAE | KSA

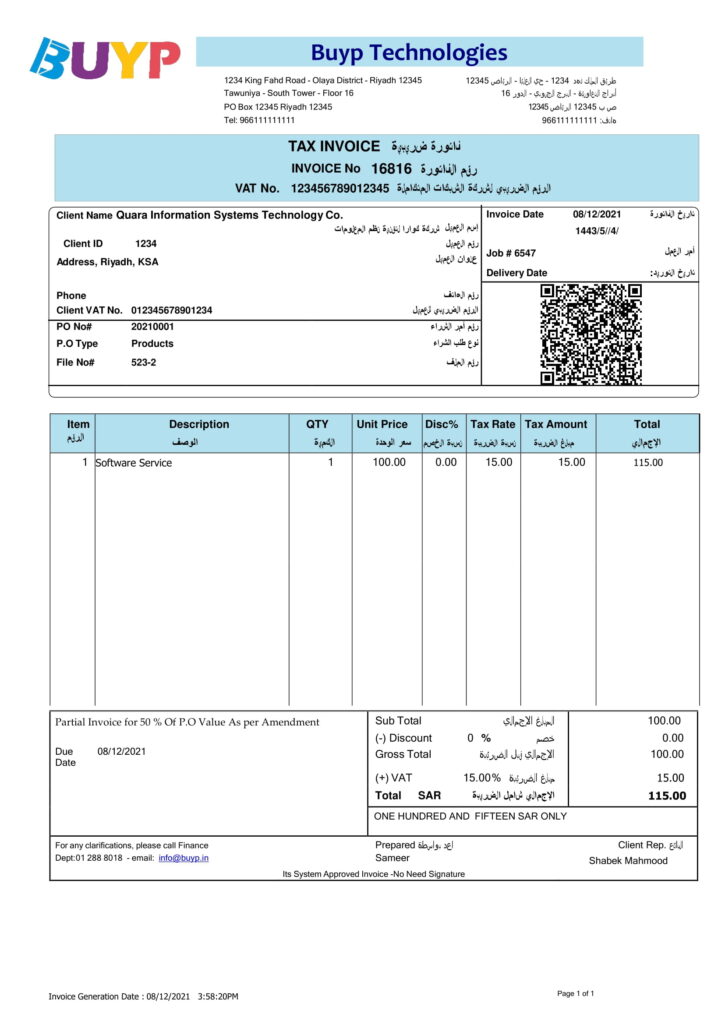

E-Invoicing is the process of generating and storing invoices in electronic format. This includes the Invoices, Credit notes, debit notes, and supplier bills. The E-Invoicing policy has been made mandatory by the ZATCA ( Zakat, Tax and Custom Authority) in Saudi Arabia from December 4, 2021. The deadline to implement the E-Invoicing in Saudi Arabia is on the above-said date. Buyp Technologies is a ‘ZATCA Approved’ E-Invoice Software solution Provider that will help the e-invoicing process for the companies.

The ZATCA process of E-invoicing consists of two phases. Every Taxpayer must produce valid electronic invoices. A paper receipt that changed over into an electronic arrangement through adapting, filtering or some other strategy is not viewed as an electronic receipt. As per the rules of the ZATCA, only an authorized provider must produce the E-Invoices, Credit Notes, Debit notes for the businesses. The KSA taxpayers, unlike others, can submit credit or charge notes through the E-invoicing in Saudi Arabia endorsed by ZATCA for which Buyp Technologies services are approved. The E-invoice will only be accepted if it comes through an endorsed provider.

After the E-invoice has been made, Regardless, of the buyer or customer wants to return any item or not accept service. Buyp Technologies will help the businesses to produce a Credit Note through their approved E-invoicing framework as mandated by ZATCA. To manage businesses efficiently and transparently, the regulations of the E-invoice have been implemented. The VAT management of KSA has to be streamlined for the businesses in the Kingdom to increase their revenue through tax.

The E-invoice system provides essential information for validating the documents through the official portal of e-invoicing. An e-invoice is issued, transmitted, received, and processed electronically. Our e-invoicing integrated software solution that enables a fully automated flow from one company’s ERP system to another. ZATCA e-invoicing is sent electronically to customers they can pay it via internet banking or credit card. It is the way of the future because of the multiple benefits that it brings.

The E-Invoice has two phases, the first phase will begin from December 04 2021 onwards. All the taxpayers in the Kingdome should change their current Invoicing method to the newly implemented E-Invoicing method on or before the deadline. The E-Invoice must have the information related to the buyer, seller and should be validated with a QR code specified in the E-Invoicing policy.

The second phase of the E-Invoicing policy will be started on the 1st of January 2023. Once the second phase is in effect, all the invoices generated by the E-Invoicing application should be validated and verified through the ZATCA portal. The E-Invoicing providers should integrate the Software system to the ZATCA Portal.

Today E-invoicing is working everywhere. One of the specific elements of the Saudi Arabia market is its heterogeneous nature. It is substantially more different, for instance than either the European or Latin American business sectors. The regulations are implemented to manage the business more efficiently, transparent, secure, Transparent, and standard. The government wants to streamline the vat management process for the businesses running in Kingdom to increase the revenue through the tax. The E-invoice policy ensures the uniformity of the electronic invoice and ensures there are no fake invoices generated, the ZATCA portal will match the records and compare the input and output taxes.

E-invoicing billing software is advanced accounting software that helps you to manage the E-Invoice Process. This includes your purchase management, Inventory management, Sales Management, Finance, and accounting, We provide an all-in-one ERP Software to run your business smoothly.